Investors operating on the Spanish market are required to pay several corporate taxes, as prescribed by thecommercial legislation applicable here. Starting with 1st of January 2016, the level of corporate taxation has been lowered, from a rate of 28% to 25%. The tax rate is applicable to bothlegal entities established on the local market, as well as for foreign companies represented in Spain through a permanent establishment. Our team of Spanish company formation representatives can offer assistance on the taxes applicable to companies in Spain and can present in-depth information referring to taxable periods available here.

Table of Contents

What is the value of the corporate tax in Spain?

Spanish companies are required to pay several taxes, such as the corporate tax and the value added tax. It is important to know that, starting with 2016, small companies (which are defined by a small number of employees), are imposed with a 25% corporate tax rate when the turnover of the company is lower than EUR 10 million. Newly incorporated companies are required to pay a smaller corporate tax, which was established at 15%, starting with 1st of January 2015.

Spanish businesses are also imposed with the business and professional activities tax, which is applicable to various categories of entities carrying operations in artistic industries. Businessmen should know that this tax can’t be imposed on a higher value than 15% of the taxable profits of the respective entity; our team of Spanish company formation agents can offer more details on the above mentioned taxes.

Businessmen seeking to start the procedure of company formation in Spain should know that the basic corporate tax is also applicable to entities such as: mutual insurance societies, mutual guarantee companies, trade unions, professional associations, non-profit organizations that are not regulated by the Act 49/2002, credit cooperatives, rural savings banks, and others.

It must be noted that legal entities that are registered as public limited investment companies that are listed on the property market are exempt from the payment of the corporate tax as a general rule, but the tax can apply in certain conditions. A non-profit organization that is regulated under the rules of Act 49/2002 is charged with a tax of 10%.

A lower tax, of only 1%, is charged for specific financial investment funds and for certain categories of investment companies with variable capital (SICAVs), as well as for real estate investment funds; those interested in receiving more information on the taxation of these types of entities are invited to request more details from our consultants in company formation in Spain.

Payment of the corporate taxes in Spain

According to the applicable law, the investors have to pay the corporate tax in specific periods of the year. As such, the corporate tax is due within a period of six months and 25 days after the accounting period has ended. Instalments of the corporate tax are paid in three periods: April, October and December. Companies are also liable to capital gains tax.

Tax minimization procedures in Spain

Non-resident individuals and companies are taxed only for the income they obtain throughout their business activities in Spain. According to Spanish law, a resident is a person who has been living for more than 183 days in Spain; also, if a person has business activities here, he or she can also be considered a resident.

A foreign investor in Spain should know that he or she has the right to choose if the corporate tax will be paid in Spain or in the country of origin, as long as Spain has signed a double taxation treaty with the respective state.

In 2015, the Spanish government reduced the corporate tax rate from 30% to 28%, and starting with the beginning of 2016, the companies set up here benefit from a new reduction for the corporate tax, which was reduced to a rate of 25%.

Small and medium-sized companies can benefit from a reduction of the income tax rate; our company formation specialists can provide further information on this tax measure. It must be noted that from the beginning of 2015, all newly incorporated companies benefit from a corporate tax rate of 15%, applicable to the first two years of activity with taxable profits.

Corporate taxes in Spain

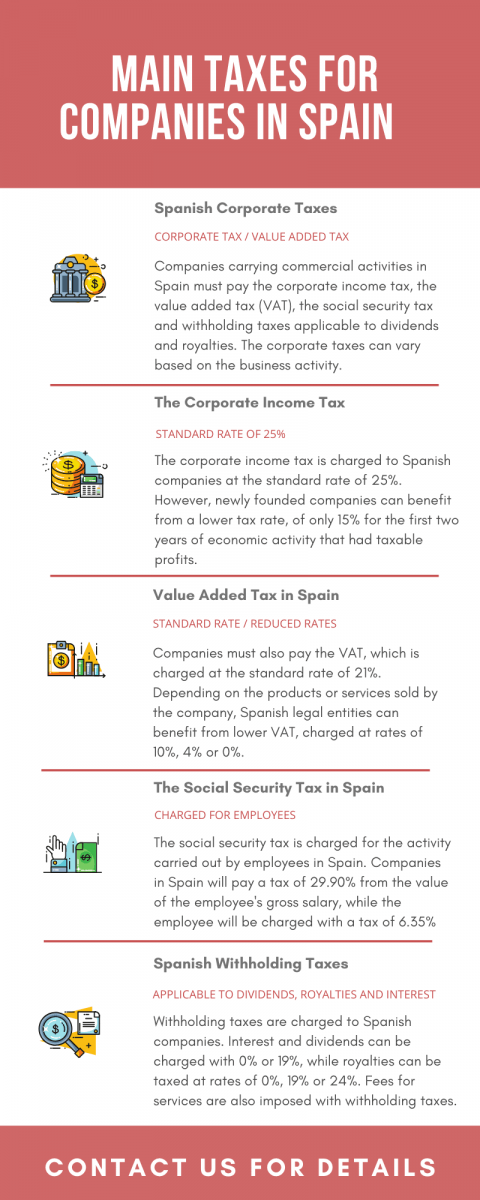

Companies in Spain that are regulated by the provisions of the commercial legislation are legally required to pay a set of taxes, considering that they are commercial entities incorporated with the purpose of obtaining a profit for the activities they carry on the Spanish territory. All Spanish-incorporated companies have to pay the following taxes:

- company tax – is paid as a percentage of the profits obtained by the company and it is charged at the standard rate of 25%, while newly founded businesses are charged with a rate of 15%;

- social security tax – paid by the employer for each employee working in the company at the rate of 29.90%, while the tax charged to the employee is of 6.35%;

- value-added tax (VAT) – the standard VAT is established at a rate of 21%, but it may vary according to the field of activity – you can find out more on the VAT rates from our specialists in company formation in Spain;

- reduced VAT rates – companies can also be charged with reduced VAT rates of 10%, 4%, and 0%, depending on the types of services or products they sell on the Spanish market;

- withholding taxes – the rates at which companies are charged with withholding taxes depend on the tax residency of the company and they can vary be of 0% or 19% for the taxation of dividends and interest, 0%, 19%, and 24% for the taxation of royalties or of 0%, 7%, 15%, 19% or 24% for the taxation of fees for services.

Taxation for individuals in Spain

Resident individuals are subject to worldwide taxation on their income produced in Spain while non-residents are only taxed on their income produced in the country. An individual is considered a Spanish resident if he or she spends more than 183 days of the tax year in the country. Spain imposes a progressive personal income tax system. The tax year is generally the calendar year both for individuals and for legal entities. With regard to the taxation of individuals, the following tax rates are available:

- 9.5% – applicable to a taxable income with a value of a maximum EUR 12,450;

- 12% – charged for incomes ranging from EUR 12,450.01 to EUR 20,200;

- 15% – the tax rate is available for an income ranging from EUR 20,200.01 to EUR 35,200;

- 18,5% – charged for income of minimum EUR 35,200.01 to maximum EUR 60,000;

- 22.5% – applicable to any income with a value of more than EUR 60,000.01.

Natural persons can also be charged with the payment of the capital gains tax, which is applied in Spain at rates ranging from 19% to 23% (it follows a progressive tax base as well). The overall tax burden applicable to natural persons in Spain can also vary based on the region where the taxation takes place.

Persons who are tax residents in Spain must know that the Spanish government has reintroduced the wealth tax, applicable to the declared wealth of a person living in this country. The tax is charged on a progressive system, which means that assets with lower values with be charged with lower rates, while assets with high value will be charged with the highest rates prescribed for this type of tax.

Please mind that in the case in which a person has a habitual residence in Spain with a value of up to EUR 300,000, the tax will not apply. Non-residents will also be charged with this tax, as long as they have various assets with Spanish tax origins. The value of the net wealth tax ranges from 0.2% to 2.5% from the value of the assets the person owns here.

We recommend the services offered by our accountants in Spain if you want to open a company in this country. Bookkeeping and payroll are among the essential services and procedures related to accounting, and we can explain in detail what they involve. Also, in order not to run into problems or paperwork errors, we can offer assistance for tax registration. Moreover, we offer investment consultancy for those who want to develop their portfolio and make other investments.

Investors are invited to watch the next presentation for further details on the tax minimization procedures available in Spain:

What are the VAT obligations in Spain?

Another important tax in Spain is the value added tax (VAT), at the standard rate of 21%. There are reduced rates for certain products and services: 10% for cultural events, hotels and most drinks and 4% for basic food. Companies that are VAT payers and which are involved in import-export activities must also conclude all the formalities for applying for EORI in Spain.

Businessmen who want to open a company in Spain that will be liable to the payment of the VAT must take the necessary steps in order to register for VAT and to make the VAT returns as per the Spanish tax law. Please mind that the registration is mandatory for entities that are taxpayers in this country.

Companies in Spain can submit the VAT returns on a monthly or quarterly basis and the system applicable to an entity is based on the company’s turnover. Thus, monthly VAT returns are required for legal entities in Spain that have a turnover of more than EUR 6 million in the previous financial period, while businesses with a turnover below this threshold can select the quarterly VAT returns; more information on how a company has to pay the VAT can be obtained from our team of specialists in company formation in Spain.

The procedure has to be completed with the Spanish Tax Agency (Agencia Tributaria), which is the institution in charge with the taxation of various taxable entities in Spain, such as natural persons, legal entities, non-resident companies obtaining taxable income in this country and any other type of entity charged for its income.

The legislation for foreign investments in Spain has been changed and it is favorable for attracting new businesses in this country. The goal of the Spanish authorities is to attract more foreign investments and to protect certain sectors that are vital for this country. Because of this, the Spanish authorities imposed some restrictions on the fields such as air transport, radio, television, raw materials, private and national security etc. Businessmen interested in receiving further details on how to pay taxes in Spain can address to our team of Spanish company incorporation representatives.